Finance

Resona Bank, Limited.

Using a Dynamics 365 Portal to Build a Structure in a Short Timeframe to Support a New Financial Service and Streamline Non-Face-to-Face Operations

At Resona Bank, Limited (hereinafter “Resona Bank”), which has developed a unique business model combining the features of a city bank and trust bank, an operation planning department took the lead to use a Microsoft Dynamics 365 (Dynamics 365) portal to build a corporate account and card loan application service and operational system in a short timeframe. They are working to improve customer satisfaction and streamline business processes.

(From left) Resona Bank Takeshi Fujiyama, Manager in charge, Corporate Business Planning Division; Ryosuke Tsurumi, Chief Manager, Corporate Business Planning Division; Takuya Ohe, Manager in charge, Corporate Business Planning Division; Katsuhito Tsukagoshi, Corporate Business Planning Division

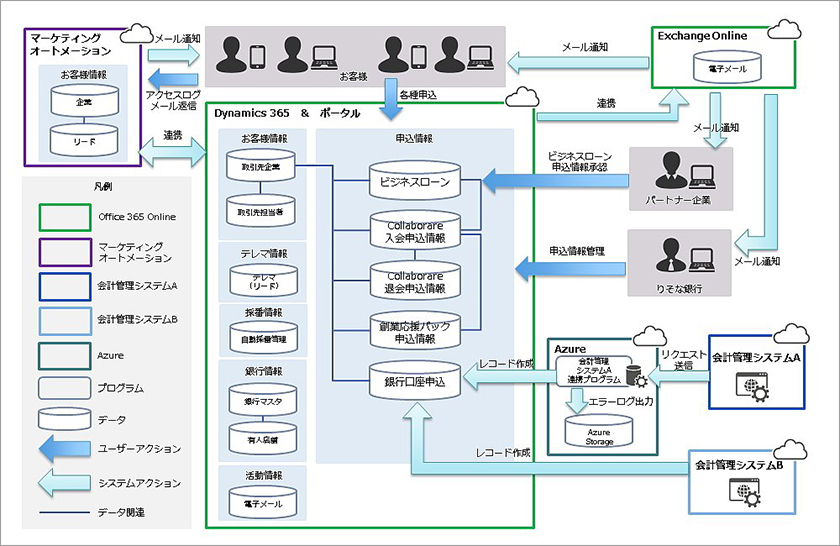

[System Overview]

Realizing a Service Portal for Start-ups and a Series of In-House Processing Systems on Dynamics 365

Please give us an overview of the system that was built with JBS support.

We built a system using the portal function of Dynamics 365 to receive applications for various services geared toward start-up companies such as those detailed below, and also for the series of processes that take place in-house after receiving the applications.

- Corporate account opening

- Start-up support pack(support service such as streamlining fund settlement opResona Collaborare (membership site that plans and delivers useful information for small and medium-sized enterprises)

- Resona Collaborare (membership site that plans and delivers useful information for small and medium-sized enterprises)

- Resona business loan Katsudoryoku (for Resona Collaborare members)

For example, until now opening a corporate account required several visits to the bank and the submission of various documents. We made it possible to do various procedures in advance online, such as document submission (account opening portal), so that accounts could be opened with a minimal number of visits.

For in-house administrative processes, we realized consistent functions through Dynamics 365 Customer Engagement and Office 365 from the processing account opening portal to the administrative desk and contact desk, making it possible to efficiently go through the series of processes while being legally compliant.

Additionally, we aim to enhance services by linking the portal function to various services and systems such as the marketing automation tool.

Diagram of Features

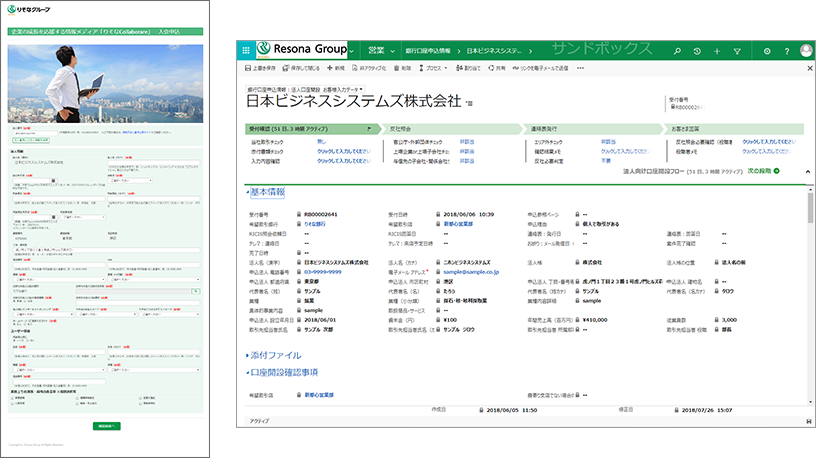

System use display

(left: Resona Collaborare membership application screen,right: display for persons in charge of opening new corporate accounts)

How long was the building period for the system?

The function for opening corporate accounts, which was released first, was built in about two months. We gradually added functions and we were able to build the current four functions in about one year.

How did you realize such development in such a short timeframe?

Ryosuke Tsurumi, Chief Manager, Corporate Business Planning Division Resona Bank

When we conveyed a rough outline of the general characteristics and what we wanted to achieve, such as “we want a system that does this when we do this,” JBS immediately presented us with a prototype. Using that prototype as a starting point, we repeated the steps of adding and revising features and specifications and having JBS make another prototype to build the service. That was why we never ended up with functions and features that differed from what we had envisioned. So we were able to avoid having to make major modifications.

Additionally, by taking such development steps, we were able to determine functions that it would be necessary to prioritize, while narrowing down the functions necessary to release the service and keep them to a minimum. I think that was another reason we were able to build the system in a short time.

[Background to Implementation]

Developing Cloud-Based Non-Face-to-Face Services Aiming to Streamline Non-Face-to-Face Operations and Improve Customer Satisfaction

hat was the background to building such a system?

It is said that out of all the companies in Japan, 99.7% are small and medium-sized enterprises and that individuals own about 1,700 trillion yen in financial assets. Resona Bank has established a solid client base mainly among such small and medium-sized enterprises and individuals, offering wide-ranging solutions including trust banking.

On the other hand, when looking at Resona Bank alone, it has about 260,000 corporate clients, but in the current situation, there are only about 40,000 companies that are borrowers among them and only about 50,000 companies that are covered by face-to-face sales. Therefore, vitalizing transactions with the 200,000 companies that we have not been able to approach face-to-face and increasing the number of new clients are our important missions.

Takeshi Fujiyama, Manager in charge, Corporate Business Planning Division Resona Bank

However, since we cannot massively increase face-to-face operations, it is important to provide non-face-to-face services that are appealing, efficient, and will continue to be chosen by customers. At the same time, we must aim to streamline operations, while also ensuring compliance, improving service levels and providing added value. To this end, our team is implementing various operational reforms. This undertaking is one such reform.

In particular, for companies that have just started their business, there are many merits to being able to receive such services easily. By enhancing and increasing the types of services we provide, we hope transactions with Resona Bank will increase and that customers’ trust will improve. On the other hand, Resona Bank is trying to streamline and standardize operations through such services and aiming to establish a structure to concentrate human resources on work that supports our customers.

There are still few financial institutions in Japan that use a cloud-based service to build a

system in a short period through an agile approach. Did this cause any problems?

Perhaps it is not something that needs to be stated explicitly, but speed is of essence when advancing operational reforms. That said, we did not prioritize streamlining and speed at the expense of the specifications and security that we must provide as a financial institution.

In building the system, we checked strictly whether we were in compliance with FISC guidelines. Additionally, since the system was not directly linked to our core system, there were no major limitations in the service provision infrastructure or building methods.

[Reason for Selection]

Trust for JBS Who Understood Our Wishes Accurately and Clarified What Was Feasible and What Was Lacking for Realization

What was the reason you adopted Dynamics 365?

We use Dynamics 365 for in-house operations at Resona Bank. From experience, we thought the portal function could be applied to transactions with customers and we could build a service without a lot of time and effort. Since there was already a track record of using Dynamics 365 at the company, it was also a merit that the necessary procedures for implementation would be smooth.

What was the reason you commissioned JBS to support building the system?

Takuya Ohe, Manager in charge, Corporate Business Planning Division Resona Bank

We had an image of the service in mind, but since we were not engineers, we did not have confirmation on what we could achieve or how far we could go with Dynamics 365. Of course, we couldn’t build the actual system either. Therefore, we were considering the use of an expert when Microsoft Japan Co., Ltd. introduced us to JBS.

What was the reason you commissioned JBS to support building the system?

We had an image of the service in mind, but since we were not engineers, we did not have confirmation on what we could achieve or how far we could go with Dynamics 365. Of course, we couldn’t build the actual system either. Therefore, we were considering the use of an expert when Microsoft Japan Co., Ltd. introduced us to JBS.

[Impact]

A Team of a Select Few Establishes a Structure to Release the Service in a Short Time

Has the provision of the service produced results?

The response from customers who have actually used the service has been largely positive. It has led to reducing the burden of related work on the branch-side, allowing us to focus on work such as proposing resources, so it is coming together as initially planned.

At the same time, there is still a lot of room for efforts with regard to increasing the number of new customers. While we will further enhance services and functions, at the same time I think we need to publicize more widely that Resona Bank is actively developing such a service.

On the other hand, the business planning department members taking the lead to build and provide such a

service in a short timeframe is also a good outcome. I think that using the Dynamics 365 service platform

and being able to establish a structure for development and operation was one of the good experiences we

gain this time.

Another good point was that we were able to handle revisions and maintenance after launching the service

with in-house members alone.

Katsuhito Tsukagoshi, Corporate Business Planning Division Resona Bank

[Development Going Forward]

Using Dynamics 365 as a Starting Point to Build a Structure to Further Enhance Services and Improve Customer Satisfaction

What do you have planned for future development?

We are considering the horizontal expansion of the service and functions developed this time to other banks in the same group, but there are still many services and functions we want to realize. Now that we are able to add new services and improve functions swiftly and flexibly, we would like to continue to streamline non-face-to-face operations while expanding services, aiming to further improve customer satisfaction.

Additionally, we will consider using the Dynamics 365 portal as a starting point to link with various systems while establishing a structure to enhance services and improve customer satisfaction. For example, we could realize a structure to propose optimum services and products by analyzing customer trends and account activity data through BI and linking with an AI chatbot or contact center.

[Assessment]

Realizing the Service in a Short Timeframe with a Small Team from the Business Planning Department Thanks to a Reliable Partner

What is your assessment of JBS?

Because the process differed from the traditional process of taking the time and effort to decide on the specifications and requesting the information systems department to build a system, there may have been members who were concerned until the prototype was actually presented. However, the response of JBS was excellent and dispelled any such concerns immediately.

They responded to our questions and requests clearly without any ambiguity so we were able to move forward with the development of the service with peace of mind. JBS has many young and outstanding members with flexible ideas who actively give advice and make proposals rather than simply do as they are told, so they were very reliable.

Without the support of JBS, a small team of members who were not even engineers would not have been able to launch such a service in a short time. There are still numerous services and functions we want to realize, so I hope they will continue to support us in the same way.

Comments from JBS

First of all, I am very happy that we were able to use the new portal function in Dynamics to execute a project that directly involved Resona Bank’s business. On the other hand, as our client stated, I feel that by creating new services we can transform it into something that has even more value. In order to give proper shape to such visions, continue to be close to our client, and create valuable services, we will work as a united team with the client. (Katsunori Tanaka)

Katsunori Tanaka, Assistant Manager, Financial Sales Section 2, Financial Distribution Sales Department, Sales Division

By conducting agile development harnessing the easy-to-customize characteristic of Dynamics 365 and the portal, we were able to create a system alongside Resona Bank without any discrepancies in awareness. As someone on the implementation side, I am very glad to have been able to undertake development utilizing the product’s characteristics. We have already received additional development requirements for the future and we will work hard to continue to contribute further to the growth of our client’s business. (Tomoe Tanaka)

Tomoe Tanaka, Assistant Manager, Business Application Department, Business Solutions Division, Innovation Service Business Unit

By repeating a cycle of interviewing -> building -> service launching in a short timeframe, we were able to deepen our understanding of the actual work our client does and I sensed that we were steadily achieving the client’s requests. We were able to create a good cycle that promotes thinking about further new services as a result. So I hope to continue this cycle and proactively work as one team with the client. (Rikuto Hara)

Rikuto Hara, Business Application Department, Business Solutions Division, Innovation Service Business Unit

Resona Bank, Limited

Representative: President , Kazuhiro Higashi

Head Office: 2-1, Bingomachi 2-chome, Chuo-ku, Osaka

Established: May 15, 1918 (started operations on March 3, 2003)

Capital: 279.9 billion yen

No. of employees: 9,246 (as of March 31, 2018)

Business overview: Banking

Published: 2018.07.31

- Related Tag

Share

Share